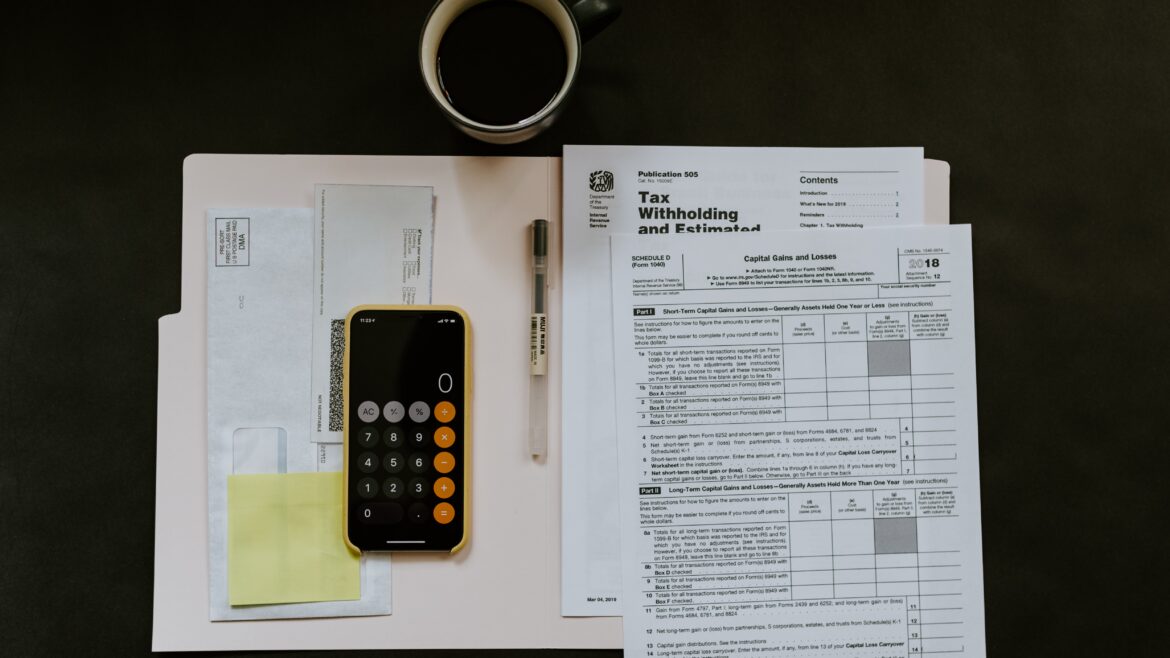

Kaitlyn’s background handling property tax issues and motor vehicle dealers has sharpened her customer service skills. She loves being able to help people find solutions and just generally make their day better. Kaitlyn stays extremely organized so she can be at her best in her role. She lives by her calendar and planner.

Growing up, Kaitlyn’s parents owned a roller skating rink and the passion for skating has stayed with her into adulthood. She’s a serial DIYer and especially enjoys silversmithing and refinishing furniture. On the weekends, you might find Kaitlyn hanging out with her two pets or volunteering in her local animal shelters or soup kitchens.

Something else: Kaitlyn believes that good things take time, so if you drop by, you’ll likely find some of those good things fermenting on her counter in the form of kombucha or kimchi.