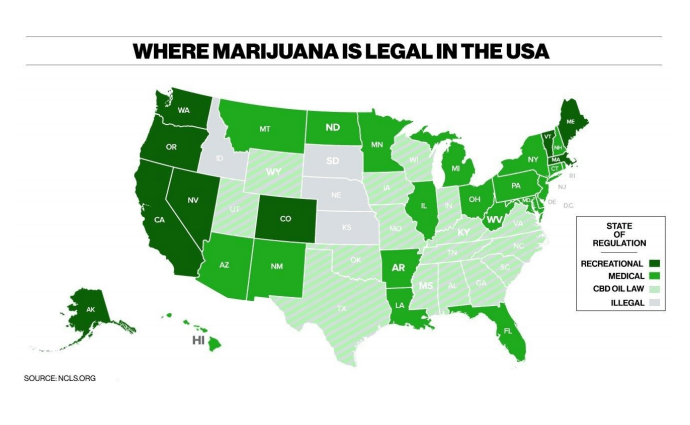

What used to be black and white, and is now suddenly gray all over? When marijuana use was simply illegal, employers could legally make employment decisions based on use alone. As states decriminalize the use of medical marijuana, recreational marijuana, and CBD oil, the conversation gets much more complicated. Nowhere is it more important to pay close attention than in the workplace.

What used to be black and white, and is now suddenly gray all over? When marijuana use was simply illegal, employers could legally make employment decisions based on use alone. As states decriminalize the use of medical marijuana, recreational marijuana, and CBD oil, the conversation gets much more complicated. Nowhere is it more important to pay close attention than in the workplace.

What are some of the complicating factors?

Marijuana products are increasingly finding their way legally into workers’ lifestyles. While marijuana’s presence in the workplace isn’t new, several factors complicate today’s iteration of the conversation:

- Even as states decriminalize recreational use, federal laws ban marijuana production and use

- Hemp-extracted CBD oil—formulated with very low levels of THC—is legal to use in all 50 states

- Medical marijuana licenses provide legal protections for certain users

- Current drug testing methods focus largely on use and are limited in their ability to test for impairment

What do we do about workplace impairment?

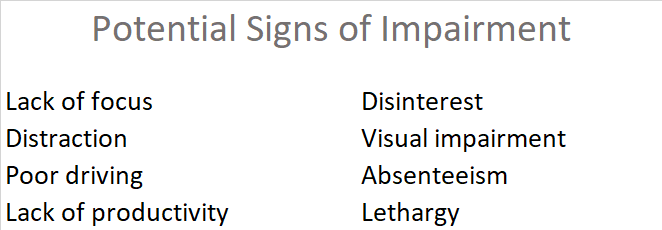

Even in a world where some marijuana use is legal, employers are still required to manage impairment. Trends show a push toward treating cannabis more like alcohol and focusing efforts on impairment rather than on use.

For example, while employers can’t tell employees not to drink, they can require employees not to be drunk at work. Even if the drinking happened outside of the office, drunkenness in the workplace hinders workers’ ability to do their job. To varying degrees, and depending on the role (operating heavy machinery, for example), workplace impairment could affect the employee, company equipment, and the public.

Can we talk about legal stuff for a minute?

For every case that rules in favor of the employee, there’s one that rules in favor of the employer. As individual cases play out in the courtrooms, time will tell which ones set the precedent as the law of the land.

In California’s Ross v. Ragingwire case, the courts ruled in favor of the employer, citing the California Fair Employment and Housing Act (FEHA), which does not require employers to accommodate medical marijuana use.

On the other end of the spectrum, in Whitmire v. Wal-Mart Stores, Inc., the court sided with an employee with a medical marijuana card. It determined that Walmart could not fire her simply for testing positive for marijuana metabolites. She was a legal user who claimed not to smoke at or before work. To justify her dismissal, Walmart would need to prove she was impaired at work—a much harder task.

How do we update our policies to evolve with the times?

Black and white “zero tolerance” statements may not serve employers’ best interests anymore, but that doesn’t mean it’s a free for all. It’s really about updating your workplace policies and complying with best practices. Know the rules in your state and update your policies and procedures accordingly. Consider including a definition of workplace impairment and detailing progressive discipline policies to address the behavioral challenges.

Should employers identify signs of impairment (glassy eyes, changes in behavior, etc.), well-written policies and procedures can guide the response and remove as much subjectivity as possible.

What about hiring and firing?

Hiring and firing bring up challenges from both legal and operational standpoints. First, a note on the legal side: in most states that have decriminalized marijuana use, businesses are still legally able to fire workers who test positive. This is the case here in Colorado. On the other hand, in Maine (another state that has legalized recreational use) companies are no longer able to fire or refuse to hire someone for using marijuana outside work.

Even where employers can legally make hiring and firing decisions based on use, the same article indicates that some companies are still testing for other drugs but dropping marijuana in the pre-screening tests. The article quoted James Reidy, an employment lawyer, saying that some companies have a hard enough time filling positions and “don’t want to exclude a whole group of people.” Instead, “companies are thinking harder about the types of jobs that should realistically require marijuana tests. If a manufacturing worker, for instance, isn’t driving a forklift or operating industrial machinery, employers may deem a marijuana test unnecessary.”

The bottom line

Regardless of anyone’s personal feelings about cannabis, the conversation around marijuana use and workplace impairment is changing. This affects businesses whether they want to think about it or not. As always, there is no gray area in this simple fact: addressing changes proactively makes life better later.

About PayReel:

At PayReel, we minimize the time and effort it takes to get you ready for your project. Rely on PayReel to assume all of the risk associated with contingent workforce management and get back to the business at hand. We make sure everyone gets paid quickly and easily and have Client Relationship Managers on call around the clock to answer your questions. All you have to do is call 303-526-4900 or email us. The PayReel team makes live event, corporate media, and brand management payroll easier, faster, and seamless.