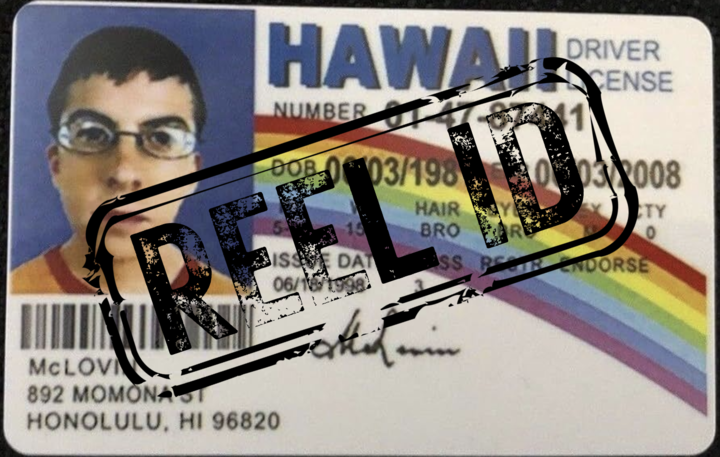

As of May 7, 2025, U.S. travelers must show a REAL ID-compliant license (or passport) to board domestic flights or enter certain federal buildings. But according to Fox News, a significant portion of the population still doesn’t meet the new standard.

For companies managing a contract workforce, this isn’t just a travel issue, it’s a workflow risk that can lead to missed flights, delayed projects, and unhappy clients. And it’s not just about one worker—it’s about how easily a single oversight can ripple across your entire operation. When you’re juggling deadlines, client expectations, and cross-country logistics, one small misstep can turn into a big mess.

Here’s how to handle REAL ID enforcement without it becoming a last-minute scramble.

Why REAL ID Is Still Creating Problems

The deadline may have passed, but the challenges are just now showing up in the day-to-day:

Freelancers are showing up at the airport with outdated IDs.

Projects are delayed due to missed travel.

Last-minute worker replacements are disrupting schedules.

And because compliance varies by state, age group, and region, your team might not realize there’s a problem until it’s too late.If you’re not already checking for REAL ID compliance before assignments go live, you’re rolling the dice on smooth delivery.

At PayReel, we’ve guided companies through compliance changes like this before. From onboarding and paperwork to scheduling and worker readiness, we help ensure nothing gets in the way of the job getting done.

How to Stay Ahead of REAL ID Delays: A 5-Step Plan

Add REAL ID Checks to Onboarding

Don’t assume workers are compliant –ask. Update your intake forms to include REAL ID confirmation, and request a photo or scan of the ID in advance. We’ve built this into our platform, so it’s automated, secure, and easy to track.

- Reach Out to Existing Workers

Send a quick message to your active contractors explaining what REAL ID is, why it matters, and how to upgrade. Include links to official DMV sites. Pro tip: a heads-up now can save you hours of rescheduling later. - Train Your Ops and Scheduling Teams

Your internal staff should know how to spot a REAL ID and when to raise a flag. It’s usually just a star in the top corner –but knowing that can mean the difference between an on-time flight and a missed job. - Set Clear Policies

Make it a rule: no flights or secure-site access without a REAL ID on file. We help clients track this in real time, so they’re never caught off guard. - Offer Help for High-Value Workers

If one of your key freelancers is still behind, it may be worth helping them navigate the process or even covering the cost. It’s a small step that keeps your projects on track.

REAL ID is just one of many changes that affect how you manage a flexible workforce. What sets PayReel apart is that we don’t just offer a platform; we partner with you to keep your operations smooth and compliant, even as the rules change.

Here’s what that looks like in practice:

- We build REAL ID checks into your onboarding process

- We flag missing documentation before it becomes a problem

- We give you visibility into workforce readiness, so no one slips through the cracks

Let’s Make This One Less Thing to Worry About

You’ve got enough moving parts already. Worker ID compliance shouldn’t be the thing that causes a last-minute delay, a lost booking, or a frustrated client.

We’ll help you get your team ready –and stay ready– so your projects run smoothly from start to finish.

👉 Talk to us today about how we can help build a better system around compliance, onboarding, and freelancer management.