Today’s workforce decisions are more than just business choices, they’re shaped by global politics, changing laws, and the growing use of contract labor. When tariffs raise costs, when labor laws shift, and when more work moves outside the bounds of traditional employment, companies are left figuring out how to stay compliant, stay efficient, and stay in business.

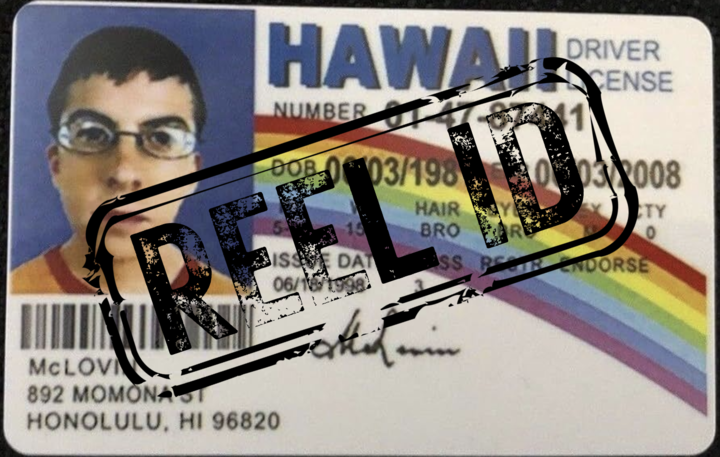

Blurred Lines

The lines between global trade, government policy, and workforce management are more connected than ever. Tariffs and other trade restrictions affect the bottom line, which pushes companies to rethink how they hire and pay people. At the same time, governments are tightening the rules around who can legally be called an independent contractor. Put those two forces together, plus the rising use of freelancers and project-based workers, and you’ve got a complicated environment to manage. To understand how all this plays out in practice, let’s start with one of the clearest pressure points: tariffs.

How Tariffs Affect Hiring and Pay

Tariffs are meant to protect certain industries, but they also drive up the cost of goods and materials. That hits businesses hard, especially those in manufacturing or with global supply chains. When budgets shrink, labor costs are often one of the first places companies look to cut back. They may freeze wages, slow hiring, or shift more responsibility to contract workers.

And that’s where things get even more complicated. Because the legal landscape is changing fast. The rules about who qualifies as a contractor versus an employee are evolving quickly and carry serious consequences.

Changing Labor Laws and Worker Classification

Worker classification used to be fairly straightforward. But with laws like California’s AB5 and updated guidance from federal agencies, the rules have become harder to navigate. Whether someone is legally an employee or an independent contractor depends on a mix of factors:

- Who controls how and when the work is done?

- Who pays for tools and expenses?

- Is the work part of the company’s main business or just support?

- How long does the working relationship last?

The total cost of labor includes more than just wages. It includes taxes, benefits, legal risk, turnover, and the time it takes to onboard and manage workers. When compliance is handled poorly, costs go up fast. That’s why smart companies are focusing on reducing risk and staying ahead of changes.

How Companies Are Adjusting

To keep up with shifting policies and workforce pressures, companies are taking a more strategic approach to labor management by:

- Proactively reviewing worker classifications to avoid regulatory issues

- Building flexible teams that blend full-time employees, contractors, and offshore talent

- Using scenario planning to stay ahead of change

These strategies, along with resources like onboarding software, legal review services, and Employer of Record (EOR) partners, are helping teams manage the complexity by simplifying compliance, reducing risk, and freeing up internal staff to focus on growth.

Final Thoughts

Trade policies and labor laws are no longer separate from day-to-day business decisions –they’re actively shaping how companies hire, manage, and pay their people. Worker classification has become a legal minefield, and even small missteps can lead to costly consequences. Navigating this reality takes more than good intentions; it requires clear processes, reliable tools, and experienced partners who understand the stakes.

PayReel helps companies simplify compliance, manage risk, and stay nimble in a changing labor landscape. If you’re rethinking how you structure and support your workforce, now’s the time to talk.

🎧Access the Live Recording → Politics of Pay: Where Tariffs, Labor Policy, and Contract Workers Collide